6 Cons of Buy and Hope – Challenging the Investing Status Quo

Many investors look at the buy-and-hope strategy, otherwise known as buy and hold, as the pinnacle of investing success. Its popularity has made it somewhat of a cult approach, with detractors receiving the same treatment as those who dare to speak out against the favored investment method.

Moving forward, we will scrutinize what exactly buy and hope entails, further exploring the advantages and drawbacks of this avenue.

What Is Buy and Hope Investing?

What does hold mean in stocks? The buy and hope is a passive investment strategy that entails committing to your selected assets for the long term instead of continually buying and selling funds or stocks and shares. In all instances, the core principle behind the buy-and-hope approach is that it is preferable to ride out market fluctuations than try to time them. There are books that explain how simple this method can be, books like “Investing for Dummies” and “Buying Stocks for Dummies.”

Uncovering Buy and Hope How It Works

For many people, investing in a passive manner by leveraging the buy and hope strategy is essentially a question of faith. However, this is a secular faith in which it is believed that over time, a well-diversified investment portfolio would gain in value independent of short-term market volatility. Ultimately, the critical tenet of buy and hope investing is to remain involved throughout market cycles since missing even a few of the greatest days may significantly influence long-term profits.

Hence, the buy and hope approach is comparable to planting a seed and hoping for it to develop into a tree. Stocks and other assets need time to develop and gain value, much as a seed requires time, sunshine, and water to grow. And just as a tree may offer shade, fruit, and beauty, a well-selected stock or security can provide a consistent source of income, the potential for development, and peace of mind.

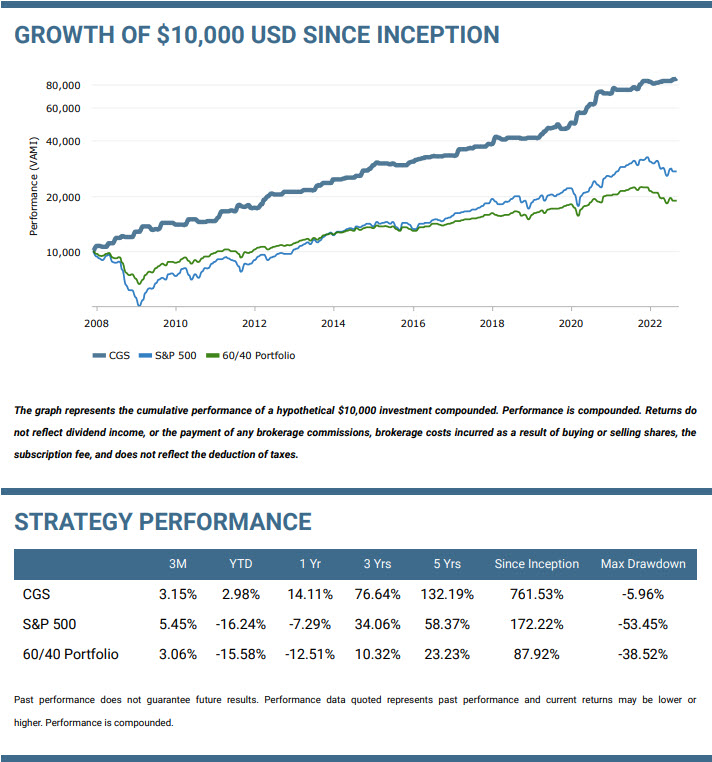

On the other hand, an active investing strategy like asset revesting involves managing positions and risk more consistently. It’s a process of selling shares when asset prices are high and starting to fall, then purchasing shares when they have fallen and start trending up again. This strategy starkly contrasts passive investing, which is merely buying assets and hanging on to them with no regard for the risks or the wasted time that can occur with multi-year drawdowns from bear markets.

Buy and hope is essentially the opposite of active asset allocation. The buy and hold strategy has repeatedly had 50% market corrections and 12- 17 year drawdowns. Investors under the age of 40 can get away with the buy and hope strategy, but once you are beyond that, it carries substantial risks which can postpone or destroy your retirement.

Exploring the Pros & Cons of the Buy and Hope Strategy

Pros of Buy and Hope Investing

Without a doubt, several advantages enhance the appeal of pursuing a buy and hope approach:

- No Trading or Investing Experience Required

So-called “asset management” is mitigated by the passive investment strategy. That is the danger of doing things like actively managing one’s portfolio positions to avoid market correction and only owning the best assets. Simply said, less active technique results in less room for mistakes on the part of humans, which can play a big role in performance because of incorrect order execution, and emotional bias’. Being able to avoid trading to reopening stocks to buy back eliminates the issue.

- Ease of Implementation

Buy and hope investing is simple to implement and complements other low-maintenance approaches like dollar-cost averaging and index fund investment. If you base your portfolio construction on these methods, you will not have to make too many decisions or do much research. In addition to saving time, this method also simplifies the process of investing.

- Saving Costs

One of the main benefits of the buy-and-hope strategy is the cost it may save you because of how seldom you have to trade when you keep positions for extended periods of time. As a result, the portfolio’s total net return is boosted due to reduced trading expenses. Better capital gains tax rates apply even if your brokerage does not charge trading commissions.

Cons of Buy and Hope Investing

Whereas investors widely know the benefits of buying and hoping, this paradigm is hindered by a multitude of factors that are not assessed in depth by most investors:

- Missing Out on Opportunities

Buy and hope investing disregards the dynamic nature of markets, which may influence economic circumstances, political events, and other factors. By hanging onto equities indefinitely, investors incur extra risks and may lose out on superior investing opportunities during falling and rising markets. On the other hand active asset revesting may provide substantial profits when the market is turbulent, such as in the bear market that followed 2008.

- Inflexibility

Predicting how long it will take for stocks or other securities to rise in value may be challenging. There is always the chance that unforeseen events, like a recession or market collapse, would cause the value of the assets to decrease. Your investment in these long-term equities will be locked up for the length of your investment, which might span many years. If another investing opportunity presents itself, you end up missing it. And if your account is experiencing a drawdown, your long-term profits are lost if you are forced to sell because of an unexpected emergency.

- Long Timespans

Another issue with buy and hope is that it implies investors have the time and patience to wait for the value of their securities to increase over time. Nonetheless, in the real world, most individuals do not have the luxury of holding onto their assets for decades. To achieve their financial objectives, they must be able to create profits in the short term.

- Emotional Attachment

Furthermore, the buy and hope strategy often causes investors to develop an unhealthy attachment to their investments. This emotional lens might distort their judgment and hinder them from making logical selling judgments. Consequently, investors may hold onto losing equities for too long, eventually incurring a financial loss.

- Principal Risk

With buy and hope, the implication is that you cannot count on having the funds available when you need them. After investing, the stock price of the firm you choose might immediately and permanently crash, which means you may lose part or all of your original capital outlay.

- Purchasing Bias

There is no way to know if or when a stock’s price will reach a given level again, and it is always subject to fluctuations. In contrast to more active investors, buy-and-hopers may not give much thought to the market price of a security. Hence, they may become more susceptible to purchasing high and selling low on stock prices.

From Assets Under Management to Assets Under Managed…

To navigate the complicated financial realm, many investors seek aid from advisors and wealth management firms. They entrust them to protect and manage their capital. In this context, the assets under management (AUM) refers to the sum of money an adviser manages.

However, most advisors invest their clients’ money using a buy and hope strategy and do nothing when the market drops. Subsequently, this passive strategy won’t yield any profits during a market downturn, and your funds become dead money for many years. When this happens, I call this type of AUM – “assets under managed,” and in short, investors are paying for poor performance, which is unacceptable when your retirement and lifestyle rely on your investment account.

Buy and hope is a strategy that is, at best, inefficient and, at worst, an excellent way to run out of money early in retirement.

Bottom Line

In today’s fast-paced and ever-changing economic climate, the buy and hope approach disregards the widespread opportunities provided by markets. Sometimes, investing with a buy and hope mindset is overly simplistic and ignores the realities of the modern investment landscape. Instead, investors should embrace a more dynamic and proactive portfolio management strategy like Asset Revesting. This involves routinely analyzing their investments and making strategic choices depending on current market circumstances and their own performance.