Preserve & Grow Invest Differently

Imagine if you could sell your investments as they started to top. Then, revest your money into different assets rising in value, and never have to hold falling positions again. That’s Asset Revesting!

Key Takeaways:

- Asset revesting strategy keeps capital invested only in assets rising in value.

- This strategy uses technical analysis to recognize price trends.

- Revesting manages risk and locks in gains with price targets and protective stops.

- Gradual reduces capital as assets rise and before they fall.

- An alternative to the buy-and-hold rollercoaster method used by firms and advisors.

- Individuals can execute asset revesting signals independently in retirement accounts.

- Use autotraded asset revesting executed hands-free at no additional cost.

Asset Revesting Strategy Definition

Asset revesting strategies, which is practiced by revesters, is a proactive investment strategy that involves holding only assets that are increasing in value. It entails actively monitoring and adjusting the investments in a portfolio by selling assets that are no longer appreciating or are starting to decline. By following an asset hierarchy, the revester then reinvests capital into assets that are either starting a new uptrend or are already rising in value.

And asset revesting strategy can focus on one of two models: a single asset revesting or a multi asset revesting. Single-asset revesters move in and out of a single asset or a small group of closely related assets. Multi-asset revesters move their capital in and out of a selection of uncorrelated assets (called the asset hierarchy), moving capital into the best asset for the current market condition.

How An Asset Revesting Strategy Works

Asset revesting helps investors optimize the performance of their portfolio and manage risk by continuously aligning their investments with favorable market conditions. By following asset price charts with technical analysis and setting both profit targets and protective stops, investors can effectively realize gains and manage risks as part of their asset revesting strategy. An effective way to increase returns, asset revesting dramatically reduces volatility in a portfolio, but it requires planning and ongoing monitoring to be successful. Asset revesting is a strategy that allows investors to stay ahead of market trends and continually experience new high watermarks within their accounts.

Technical traders and revesters believe two things:

- The way to make money is to own and hold rising assets and to exit positions not moving up.

- By analyzing and following asset price charts, we cut out the noise of news and control emotions while gaining knowledge around when these positions are rising, range bound, or trending lower.

A properly developed asset revesting system provides a revester with alerts based on technical analysis from stocks, bonds, commodities, and currencies. These alerts are then converted into actionable asset revesting signals to either enter or leave a position.

By using technical analysis as the cornerstone of our asset revesting strategy, we reduce risk, own strong trending assets, and avoid unnecessary market volatility by moving capital as needed to lower-risk assets that are rising in value.

ASSET REVESTING BOOK

This book introduces an investing style that the antiquated investment industry doesn’t want you to know about. Asset Revesting manages positions through the lens of an asset hierarchy that delivers a truly unique wealth-building experience.

Both individuals and financial advisors will gain new insights into investing realities. It’s essential reading for anyone who uses buy-and-hold and diversification to invest in stocks and bonds, with or without an advisor. If absorbed, these shocking realities and opportunities will change how you think, live, and invest.

As an Amazon Associate, we earn from qualifying purchases.

Asset Revesting Featured:

The Asset Revesting Strategy has become the choice for investors seeking a different way to preserve capital, grow wealth, and live an uncompromised retirement.

The Asset Revesting System: Step One

Asset revesting is a method that focuses on control, security, and peace of mind. The first part of this strategy involves holding and owning only assets trending higher and rising in value. Asset revesters exit positions that are not performing and deploy the capital elsewhere, with cash as a preferred position during specific market conditions.

The asset revesting strategy allows you to follow price using technical analysis to better preserve and grow your wealth in all market conditions. With continuous account growth and smart spending decisions, you never outlive your money and can maintain or live the lifestyle you envisioned.

This logic-based way to invest and save for retirement is practiced through the application of technical analysis. Essentially, this is the process of examining market data, including price, volume of trades, market cycles, and sentiment, to identify trends in the movement of an asset.

The Asset Revesting System: Step Two

The second prong of the strategy involves managing positions and risks by setting profit targets and protective stops to remove capital and avoid losses while also locking in gains. A typical revesting strategy might include a stop set at a chosen percentage below the entry price and a profit target to sell a certain percentage of the position after earning a specific gain.

It is also important to note that targets and stops are actively updated to maintain objective reward and risk levels to accommodate changes such as market volatility, price momentum, and dividend payments. Likewise, this strategy requires an investor to get comfortable with cash as a holding, as capital is not invested if there is no opportunity. This may seem overly cautious, but remember that this strategy should never result in any big losses or multi-year drawdowns. Rather, it’s based on the belief that it is better to maintain your wealth and lifestyle during higher-risk market conditions than it is to lose money owning assets that are falling in value.

Multi Asset Revesting Real-World Example

Let’s look at one example of multi-asset revesting:

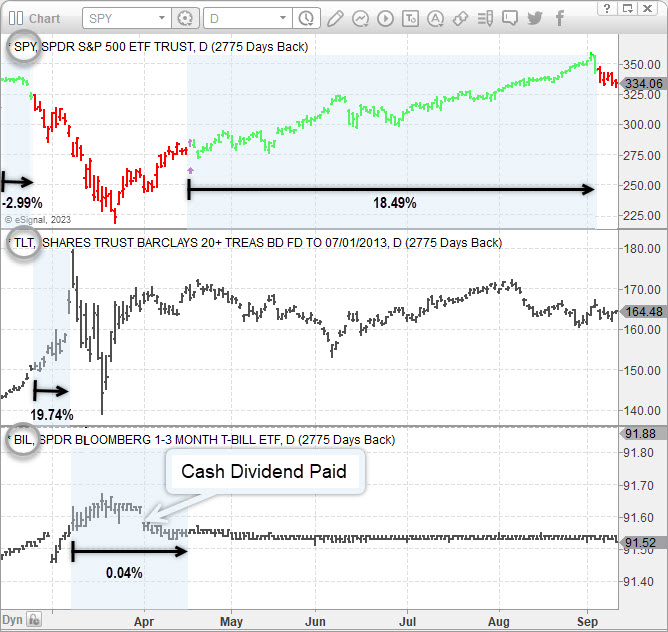

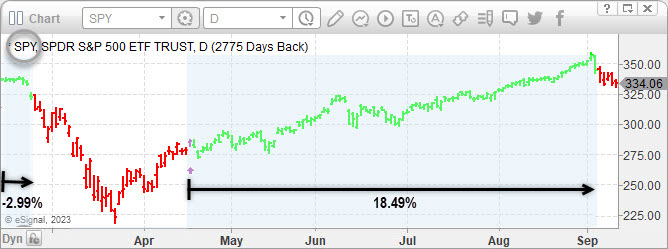

Many asset revesters had long positions in the S&P 500 and Nasdaq index ETFs leading up to the week of February 24th, 2020. They then rotated out of the equities market and into long-term treasury bonds for a 9-day position. The market correction caused by COVID-19 generated additional profits as long-term treasuries rallied 19.60% and the stock market fell by over 32%.

After exiting the long-term treasury position, revesters sat in cash waiting for the markets and watching for any hierarchy asset to stabilize and provide a new asset revesting signal. On April 20th, 2020, the stock market generated a new signal and revesters reinvested their capital back into the index ETFs priced 11% lower than where they sold them just a month and half earlier. This new index position rallied another 18% before generating a new sell signal to move safely back to cash temporarily.

The following chart shows a multi-asset revesting strategy trading equities (SPY), treasury bonds (TLT), dollar index (UUP and UDN), along with 1-3 month treasury note ETF (BIL)

Single-Asset Revesting Real World Example

In the single-asset revesting method, the revester only looks at and trades a single asset or set of closely related assets. For example, a revester focused on equities might only ever enter and exit SPY. When not invested in this asset, their capital remains in cash. This method is a bit more limited than multi-asset revesting, since the revester waits for revesting signals by sitting in cash while a multi-asset revester would be rotating into other assets.

Pros And Cons Of the Asset Revesting Strategy

Asset revesting is ideal for investors who want inflation protection, lower fees, reduced sequence of returns risk, lower drawdowns, above-average returns (especially during corrections), asset preservation, and an overall more calm and predictable investment experience. There are some considerations to make before you decide whether this method is right for you. The pros and cons of this strategy include:

Pros

- Avoids multi-year drawdowns (losses)

- Focuses on non-correlated positions

- Reduces portfolio volatility

- More consistent and predictable growth

- Low cost – annual subscription

- Can be autotraded in brokerage accounts

- Reduces financial stress and sleepless nights

- Helps achieve an uncompromised retirement

Cons

- Requires a system to identify revesting signals

- Can underperform during extended bull-markets

- Needs ongoing adjustment of targets and stops

How Asset Revesting Differs From Everything Else

An asset revesting strategy is a power and can be particularly beneficial for investors 45 and older, those nearing retirement, and retirees. Why this group of people? Because, generally, these folks do not have time for traditional strategies to recover after a crash before they draw on their retirement savings. Asset revesting involves continuously analyzing trends and looking for entry and exit signals in order to maximize returns and minimize risk. Some asset revesting newsletters have been averaging a compounded annual return over 15% since 2007 with a maximum drawdown of less than 6%.

If you’re not comfortable analyzing trends and identifying revesting signals on your own, there are providers that can help. For example, TheTechnicalTraders.com offers alert signals and autotraded asset revesting execution in self-directed brokerage accounts, IRAs, 401(k)s, and more. These providers can help you take advantage of the benefits of asset revesting without having to do all the work yourself.

Robo-advisors like Betterment and Wealthfront are popular automated investing options for individuals, but they have some downsides. For example, they typically offer a limited number of assets for investment and they don’t use the asset revesting strategy. Instead, they rely on the traditional diversified buy-and-hold method, which has led to their low annual returns. According to the Robo Report, most robo-advisors’ five-year returns (2017 to 2022) are poor, ranging from 2% to 5% per year.

Four Rules for using an Asset Revesting strategy

An asset revesting strategy allows investors to reduce risk, own strong trending assets, avoid unnecessary market volatility by moving capital to lower risk assets, and generate a steady income from the financial markets. It also requires that users follow four major rules for success.

- Rule 1: Protect capital with position and risk management.

- Rule 2: Hold only assets rising in value and quickly exit underperforming positions.

- Rule 3: Constantly review asset price trends to maintain efficient revesting signals.

- Rule 4: Continuously increase knowledge and self-discipline to better understand price trends and manage negative emotions, like FOMO and hindsight.

The Asset Revesting Strategy is a revolutionary investment method that upends the traditional “buy-and-hold” approach. Instead of holding onto positions during market fluctuations, and asset revesting strategy rotates capital into only the assets that are rising in value, avoiding falling positions altogether. Unlike traditional diversification methods used by firms like Schwab and Fidelity, Asset Revesting generates higher and more reliable returns while reducing portfolio volatility. Imagine being able to sell your investments at their peak, reinvesting that money into assets on the rise, and never having to deal with holding onto losing positions again. That’s why investors use multi-asset revesting strategies like CGS.