Key Takeaways

- Asset revesting signals are interpretations of the movement of an investment.

- These signals work by indicating when an investor should move in or out of a position and when they should change their risk management approach.

- Asset revesting signals are generated by movement in the market and are determined by technical analysis methods.

- Autotraded asset revesting signals can be executed in self-directed brokerage accounts, IRAs, 401k, trusts, corporate and other accounts.

What are Asset Revesting Signals?

For decades, we have been told that trading and investing are simple. Buy low, sell high. That’s it! Invest in something today, wait a while until it goes up, then sell. But how does the average investor know when the stocks, ETFs, and other investments they are considering are low enough or high enough to enter or exit?

The rise and fall of stock prices, over time, tells a story. Essentially, investment performance charts are signals showing the market’s “temperature” around a particular investment. A stock that is rising, for example, is being bought more than sold and is popular. One that is falling, on the other hand, is being sold more than bought and is unpopular. Of course, all of that can change in an instant—and very often does. Asset revesting signals tell revesters when to take action and enter or exit a position based on their asset hierarchy, which, in turn, helps to manage portfolio volatility.

Interpreting the revesting signals markets are sending requires following proven research and trend analysis. Through these steps, asset revesters can recognize critical signals that, when followed, can better manage both risk and returns. It is an approach that can limit large losses while also helping revesters act on opportunities that otherwise might be missed.

How Do Asset Revesting Signals Work?

Asset revesting signals provide clarity on market direction and risks by removing the guesswork from trading. Using the signals helps revesters control risk by following price trends, holding positions when assets are rising, and quickly exiting underperforming positions, thus creating dramatically lower volatility within a portfolio. When an asset revesting rule is triggered, the revester knows to take action and enter or exit indicated positions, ultimately avoiding big losses and multi-year drawdowns to outperform the average market returns over the long run.

Trading systems based on ETF asset revesting signals provide proven, repeatable processes that introduce consistency, control and capital preservation. Based on technical analysis rules rather than fundamental predictions, a revester who follows the strategy rules gains control of their emotions, particularly FOMO and hindsight.

How Are Asset Revesting Signals Generated?

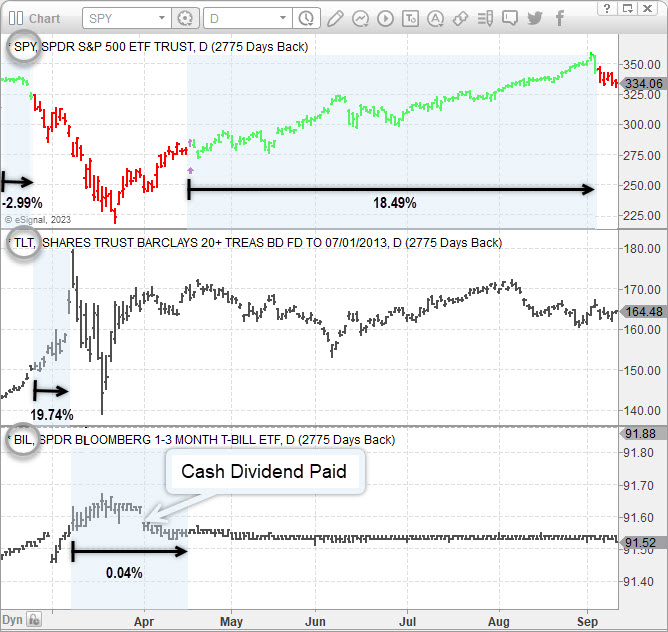

The signals followed in asset revesting are relatively simple. Before we talk about them, let’s recap what asset revesters believe. Essentially, they believe in holding and owning only assets trending higher and rising in value. That means asset revesters exit positions that are no longer appreciating or are starting to decline. That freed up capital will then either be held temporarily in cash (or cash equivalents) or reinvested into assets that are starting a new uptrend or are rising in value.

When a held asset stops rising and, through technical analysis, it’s found that the price has become bearish or weak, it creates a signal to exit. An asset that is rising in value triggers a signal to enter. Of course, a revester can rarely just look at a chart and interpret whether a signal has been created.

Indeed, the time-consuming part of an asset revesting strategy is in creating a system of signal identification. As not everyone has the time or desire to learn how to interpret market movement and convert it into signals, newsletters providing single asset revesting and multi asset revesting signals can be a portfolio saver. Asset revesting signal providers such as The Technical Traders Ltd can be a great option for those who want to get asset revesting signals to follow or have the signals autotraded in their accounts.

Can Asset Revesting Signals be used in IRA or 401k Accounts?

Asset revesting and its signals work with any type of trading instrument and any time frame. Embracing this trading philosophy reduces emotions and downside risk, and it can increase the number of winning positions.

For example, preretirees and retirees with IRA and 401(k) accounts can use asset revesting signals to trade within their retirement portfolios. For many nearing retirement, doing so becomes especially critical because it provides a clear signal for each trade prior to entering and exiting, essentially putting the odds in the revester’s favor for each trade they make.

Increasing Returns and Saving Money with Revesting Signals

Traditional financial advisors at firms such as Fidelity and Schwab charge investors an assets under management (AUM) fee. Most advisors charge a 1% AUM fee, which can add up if you have a sizable investment account. As a newsletter signal provider often has a semi-annual or annual fee that is not affected by how often trades are executed, resulting in far lower overall charges.

For example, if you have $500,000 invested with an advisor, you are likely paying $5,000 per year in AUM fees. Also, your capital is likely invested using the high-risk buy-and-hope strategy nearly all financial advisors offer, exposing investors to large multi-year drawdowns. While this strategy is fine for young investors, it’s not suitable for anyone over the age of 45 and should be considered a high-cost, high-risk strategy.

Can Roboadvisors Help Asset Revesters?

A popular alternate method of investing are roboadvisors, a type of online service using computer algorithms to help people invest their money using traditional investment strategies such as buy-and-hold. Betterment and Wealthfront are two of the most popular roboadvisors.

Millions of people have started using roboadvisors because they are a cheaper alternative to traditional financial advisors and they can help to reduce the cost of the AUM fee. Both of these services, however, are limited in their investment options. For example, Betterment can’t buy stocks, ETFs or REITs, so revesters have only a limited investment selection for their portfolio and can miss out on key opportunities each year.

Most robo-advisors don’t have a long track record, but according to the Robo Report, the five-year returns (2017 to 2022) for most roboadvisors range from 2% to 5% per year. So, while they allow investors to save on the annual cost, it’s clear that roboadvisors do not perform as well as other methods.

Unlike roboadvisors like Wealthfront and Betterment, an asset revesting signals provider with automated trading, such as The Technical Traders, can create the perfect solution for a retirement account.

Investors who are dissatisfied with the limitations of a traditional buy-and-hold investing method at firms like Fidelity or Schwab are quickly turning to asset revesting. They are avoiding the portfolio-gutting losses of market downturns and creating the ability to profit from bear markets. By using technical-analysis-based asset revesting signals with risk and position management rules to protect capital, these revesters have the potential to earn higher returns. Combined with the lower cost of asset revesting newsletters and autotrading, these revesters are coming out far ahead of the pack.