The Buy and Hold Investing Approach Is Dangerously Scary For investors 50+

In the past, buy and hold investing was a popular technique used by investors worldwide. This method of investing relied on buying stocks, bonds, commodities, and currencies and holding them for the long term in the hope that they would eventually increase in value.

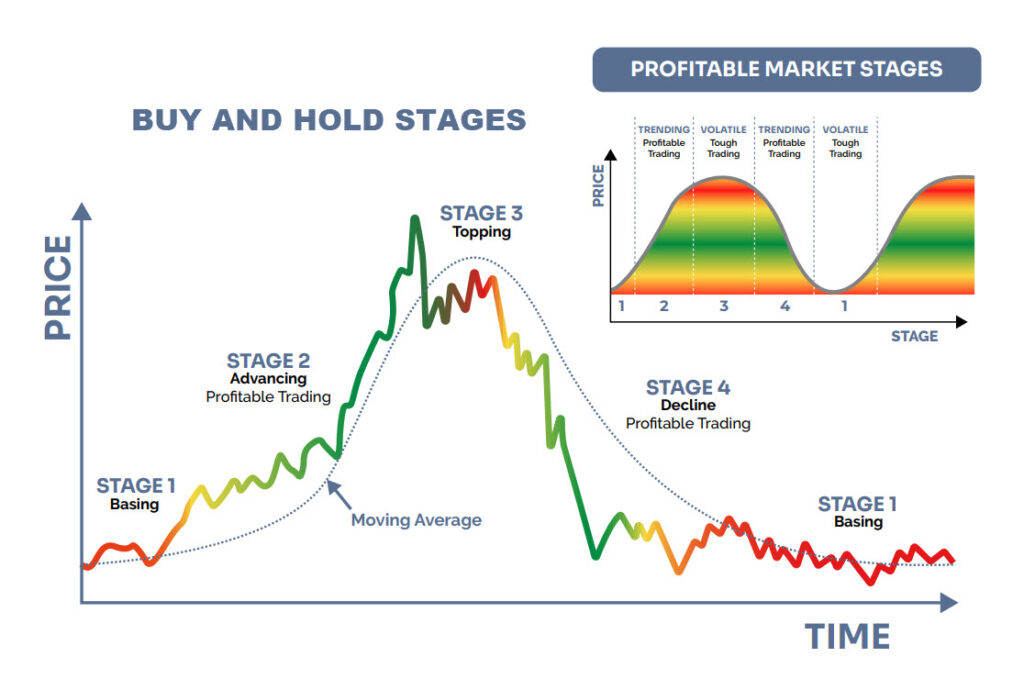

However, in recent years, this approach has been declining in popularity as more and more investors are turning to other methods, such as Asset Revesting, and technical analysis-based asset allocation. There are several reasons for this shift, but one of the main factors is the stock market’s volatility in recent years.

What is a Buy and Hold Investment Approach?

The buy and hold investing is a simple and sensible strategy for younger investors under 50. It involves identifying quality investments that you believe can grow over time, such as stocks and bonds, and then buying them with the intention of holding them to benefit from long-term increases in their value.

This means making an initial purchase and then being patient as the market fluctuates – sometimes waiting years to start experiencing gains.

It doesn’t require any specialized knowledge or intensive research. Instead, it relies on selecting investments you think you are comfortable holding on to during good and bad economic times.

Overall, buy-and hold investing is built on the basic expectation that stock and bond prices should rise over the long run. While that may be the case, the issue comes down when you plan to retire or start withdrawing money because we have seen several 5, 12, and 17 years drawdowns where you lose 30-54% of your investment capital several times during those periods. So if you are nearing retirement or retired, you should think twice about having your money invested in what I call the buy and hope strategy.

How Does it Work?

This type of strategy typically involves searching for companies with better value, meaning they are able to provide consistent returns over a longer period because they are a category-king and offer something different within a growing market.

It emphasizes buying reasonably priced investments that offer strong dividends or growth. Investors buy and hold funds like ETFs, and mutual funds to keep the cost and account volatility low.

With this method, you want to ensure your hard-earned money is working for you, not against you, but that’s not always the case, and we will explain why it does not work well.

Buy and Hold Investing… or Buy and Hope?

When some people talk about the buy-and-hold strategy, they might refer to it as “buy and hope.” This is because it is such a basic strategy that does not require any skills to execute or maintain, and investors and advisors turn a blind eye to corrections and bear markets and ignore all the risks that come with the strategy.

You’re investing in hopes of long-term growth, blindly throwing money into an uncertain future, and willing to ride the emotional and stressful stock market rollercoaster. It does not matter how much research you do; when a bear market takes hold, almost all stocks fall in value. There is no way around it if you plan to hold positions. Some individuals have focused asset allocation strategies using a Vanguard Asset Revesting strategy with ETFs to cut costs and reduce drawdowns.

Even if you are an experienced investor, having a well-crafted strategy with good long-term goals in place will not save you during a falling stock market, even if you are holding the best stocks.

Pros of This Approach

Requires little effort or know-how

The buy and hold investing can be a great fit for those of us who may not have a lot of hands-on experience in the market.

It’s relatively easy to understand since it doesn’t require any monitoring or frequent adjustments. Simply choose your desired investments, such as stocks, bonds, and mutual funds, and hold them until they meet your goals.

This approach can yield positive returns with minimal effort, so keep in mind that this might be an ideal way for you to invest if you lack expertise and are under the age of 40.

Focuses on long-term growth

Instead of trying to navigate market fluctuations to profit from rising and falling prices, the buy and hold investors focuses on selecting stocks or funds that have shown consistent growth over time and holding onto them rather than actively managing positions.

This allows you to catch all the upside movement, but it also means you must be able to stomach and weather any market downturns that take place. This is much easier said than done when you are experiencing this in real-time.

With this approach, understanding the markets, building a diversified portfolio with low-cost investments, and waiting for assets to generate gains work well for those with a 20 – 40 year investment horizon.

Provides a hands-off approach to investing

Put simply; it means diversifying your portfolio to include stocks that are expected to increase in value over a long period and occasionally evaluating and rebalancing them as you age.

Cons of This Approach

Requires patience, self-discipline, and long-term commitment

The buy and hold approach definitely has its advantages, but it does tend to require a certain amount of patience and dedication that most investors learn after it’s too late that the buy and hold strategy’s risk level is outside of their comfort zone when things get tough.

It’s important to take an honest look at how long you’re actually committed to keeping the same investments in order to make sure this strategy is right for you.

That way, you can get the most out of the investment and set yourself up for success.

Can be difficult to stick with during tough times

Sticking with a long-term strategy despite inevitable market swings can help you weather the storms and come out on top in the end.

Remember, investing for the long run means you have to ride out market peaks and troughs along the way, and if you decide to ignore risk by using this passive strategy, be sure you have a lot of time on your side.

Loses money in falling markets

One of the detriments is that when markets are falling, it fails to protect investors from major losses.

Over time stocks generally trend up, but active asset revesting can protect against loss in a downturn as investors can adjust their positions more easily and quickly to be sure they only own assets rising in value or hold a cash position.

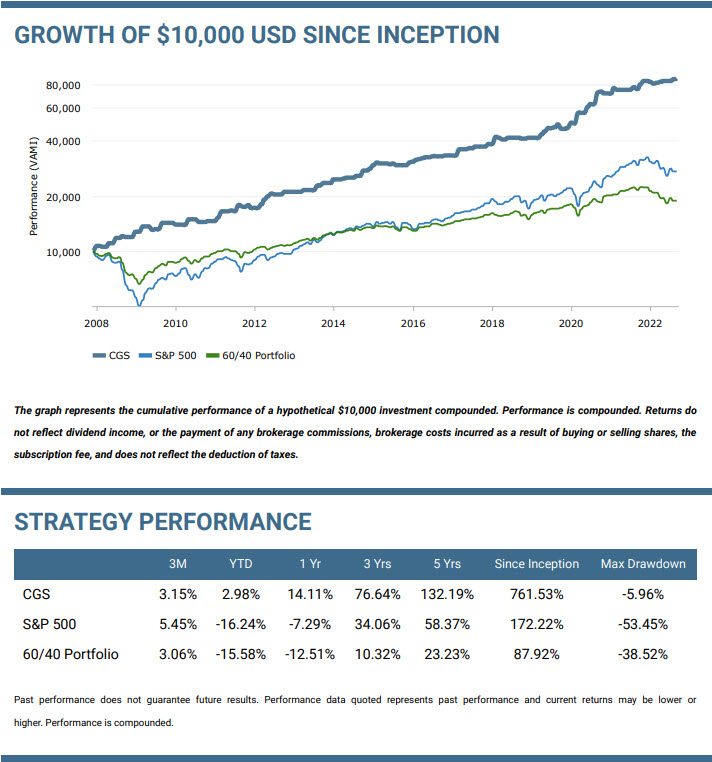

As such, buy and hold investing is not ideal for successful individuals who want above-average returns and capital protection.

Active Asset Revesting can profit during falling markets

One important consideration is that active portfolio management can be more profitable depending on the state of the market. For instance, active investors are often better able to capitalize on falling prices since they actively exit positions, not raising and revest the capital into a new asset that is increasing in value.

It’s worth looking into whether active asset revesting could help you reach your financial goals even faster. Unfortunately, not many advisors provide asset revesting, although there are asset revesting signal newsletters that can be followed and traded.

The Crux

All in all, one of the biggest major downsides of the buy and hold investing strategy is that assets under management (AUM) can become stale due to holding onto assets for too long without requiring much effort by financial advisors.

Paying an AUM fee only to watch your account drop in value can become very frustrating to experience. The only people making money during market corrections and bear markets are financial advisors who collect a fee to hold the assets under their name while you take all the risk.

Finding an optimal balance between buy and hold investing and asset revesting is key to success and allows you to enjoy the benefits of both strategies.

AUM Seen Differently – Assets Under Managed

Pensions and retirement accounts are assets that provide financial security for retirees, so when it comes to managing them, it’s important to consider the best long-term solution.

A new twist of the AUM term is starting to become more talked about and I hear it all the time for individuals who have watched their investment portfolios drop 15-35%. AUM is being talked about as Assets Under Managed. It refers to the idea that someone has invested your money with the buy and hold investing and doing nothing to protect you during bear markets in stocks and bonds.

That’s why we’ve coined the phrase Assets Under Managed… you’re paying for an underperforming portfolio due to a lack of kill and proactive management.

Final Words

Overall, the buy and hold investing strategy has its pros and cons – it can be an easy way to invest and potentially reap the rewards over time. Still, it also carries severe risk during market fluctuations and for baby boomers and retirees.

It’s important to understand your own goals and expectations so that you can make the best decision for your particular situation.

Determining whether you should use a buy and hold investing or an active investing strategy like asset revesting really comes down to understanding your investment objectives and finding the best way to reach them.

Understanding how each of these approaches will affect your portfolio will help you make an informed decision that sets you up for long-term success. Happy Investing!